CDL Downgrades Set to Reduce TL Capacity

The central theme we've been emphasizing for over a year now is the shift of freight from the for-hire market to private fleets—a trend that has significantly prolonged the soft freight cycle, especially in an economy that has exceeded expectations. However, according to the latest edition of the *Freight Forecast: Rate and Volume Outlook* report, this trend may be coming to an end.

“Lower equipment supply, especially from private fleets, could be a key factor in a market turnaround in 2025,†said Tim Denoyer, Vice President and Senior Analyst at ACT Research. “Additionally, an upcoming FMCSA regulation next month might result in the downgrade of tens of thousands of CDL holders in states where such enforcement wasn’t previously required. While it’s hard to measure the exact impact, this change on November 18 could have two positive outcomes: improving road safety and pushing truckload rates higher.â€

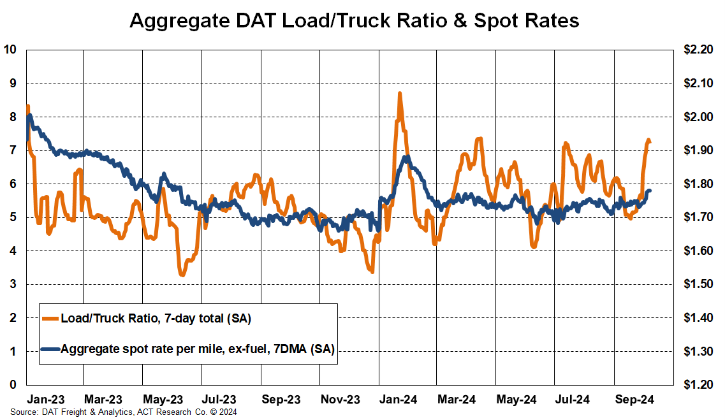

*Aggregate DAT Load/Truck Ratio & Spot Rates*

The DAT load/truck ratio isn't a simple 1 to 10 scale—it can go well beyond 11. It hit the mid-teens in 2017 and early 2018, and climbed into the high teens during 2021, peaking above 20. Our seasonally adjusted aggregated DAT load/truck ratio recently crossed 7 in early October, signaling that spot rates are likely to rise modestly in the near term.

“However, the equipment capacity rebalancing needed to push rates up in 2025 hasn’t fully taken place yet,†Denoyer concluded.

**Freight Forecast Report Overview**

ACT’s monthly 58-page Freight Forecast offers in-depth analysis and projections for a wide range of U.S. freight metrics, including the Cass Freight Index, Cass Truckload Linehaul Index, and DAT spot and contract rates by trailer type. The report delivers monthly, quarterly, and annual forecasts for the TL, LTL, and intermodal markets over a two- to three-year horizon, covering capacity, volume, and pricing trends. With detailed insights into the freight rate outlook, the *Freight Forecast* empowers companies across the supply chain to plan with greater confidence and reduced uncertainty.

**ACT Research Overview**

ACT Research is the leading provider of commercial vehicle data, market analysis, and forecasts for the North American and Chinese markets. Its analytical services are widely used by major truck and trailer manufacturers, suppliers, and financial institutions. ACT is a contributor to the Blue Chip Economic Indicators and a member of the Wall Street Journal Economic Forecast Panel. The company's executives have received numerous accolades, including election to the Board of Directors of the National Association for Business Economics and appointments as Consulting Economist to the National Private Truck Council. ACT Research has also won prestigious awards, such as the Lawrence R. Klein Award for the most accurate economic forecast over four years. Senior staff members have been recognized for their forecasting excellence, including the Chicago Federal Reserve Automotive Outlook Symposium Best Overall Forecast and Wall Street Journal Top Economic Outlook. More information is available at www.actresearch.net.

Aluminum Rod,Aluminum Welding Rods,Aluminium Round Bar,Aluminum Filler Rod

TIANJIN JIAYI STEEL CO.LTD , https://www.jiayisteel.com